When cash never hits the books, can an accounting still deliver meaningful relief? A recent decision offers answers—and warnings.

Continue Reading Can an Equitable Accounting Find the Missing Cash?

Commentary on Dissolution and Other Disputes Among Co-Owners of Closely Held Business Entities

When cash never hits the books, can an accounting still deliver meaningful relief? A recent decision offers answers—and warnings.…

Continue Reading Can an Equitable Accounting Find the Missing Cash?

General partnerships are supposed to be the easiest of all business organizations for co-owners to separate. Not in the case featured on this week’s New York Business Divorce, where it took almost ten years for the majority partners of a New York general partnership to secure a court ruling that a formal written notice of withdrawal by one of the partners dissolved the business by operation of law.…

Don’t expect anything neat and clean about the case featured in this week’s NYBD involving a contested LLC freeze-out merger.

Continue Reading One Very Messy LLC Freeze-Out Merger

Welcome to our 18th annual edition of the Top 10 business divorce cases featured on this blog over the past year.

This year’s selections include a split decision by the New York Court of Appeals in a fascinating case involving a Delaware LLC, along with Appellate Division and trial court opinions addressing stock valuation, estate…

Hoping to derive standing to sue from an LLC membership interest assignment? This week’s New York Business Divorce is another reminder that assignment of a membership interest does not convey actual membership status, with all the coveted legal rights flowing therefrom, unless the operating agreement grants the assignor such power, and, then, only where the assignor and assignee comply with all the conditions of the contract for admission of a new member. Anything less can result in total litigation defeat.…

Continue Reading Mere Assignment of an LLC Membership Interest Does Not Make You a Member

The Appellate Division, Second Department delivered last week a fascinating case pitting a deadlock-based LLC dissolution petition against an equity forfeiture provision in the parties’ operating agreement. Add to that a bracing reminder that lazy pleadings and procedural missteps in special proceedings can be outcome-determinative, and Ribeiro v Libutti, 2025 NY Slip Op 06865 (2d Dept Dec. 10, 2025), becomes a cautionary tale for business owners and litigators alike.…

Strict compliance with contractual conditions precedent, yea or nay? In New York, it depends.

Now, the general rule is that strict compliance with contractual conditions precedent is required. The New York Court of Appeals has previously held: “Express conditions must be literally performed, substantial performance will not suffice” (MHR Capital Partners LP v Presstek, …

Cross-border business divorce disputes continue to bedevil New York’s commercial courts, forcing them to grapple with difficult conflicts-of-laws questions. We feature the latest instance on this week’s New York Business Divorce.…

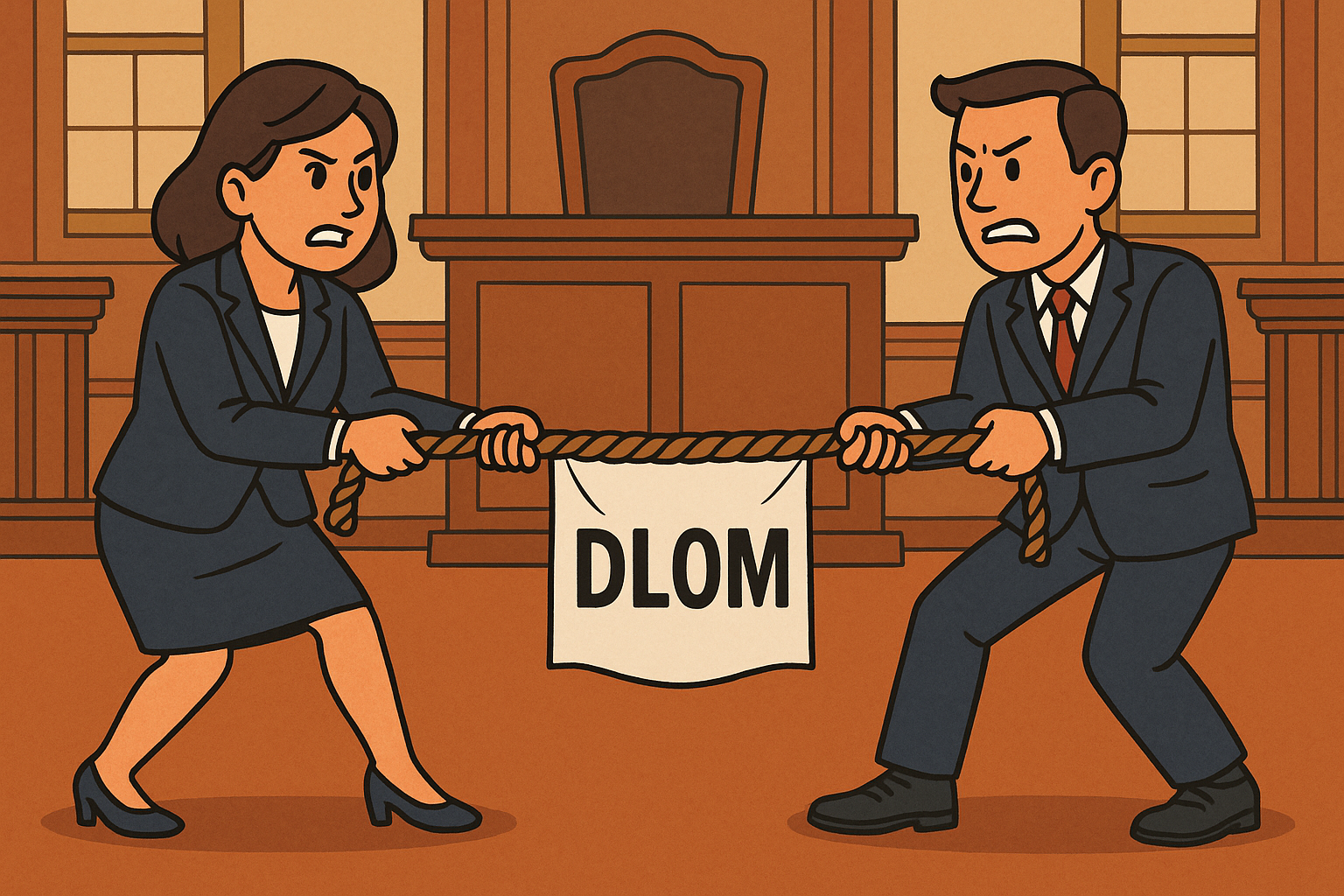

A new First Department decision proves once again that no one can agree on the Discount for Lack of Marketability.…

Continue Reading The Valuation Discount That No One Can Agree On, Still